Stock Market Psychology PDF: Insights Beyond the Pages

March 15, 2025

Introduction

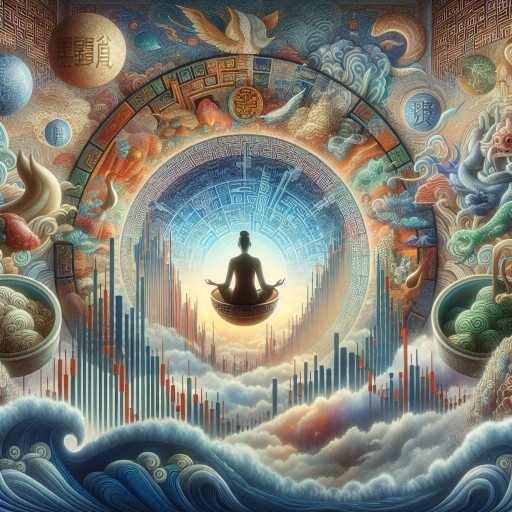

The stock market is a high-stakes psychological war, where fortunes are won and lost not just on strategy but on emotion. Every price swing reflects human behavior—fear, greed, euphoria, and panic—playing out in real time. It’s not just earnings reports or economic data that drive markets; it’s how investors interpret and react to them.

Consider this: Studies in behavioral finance reveal that investors systematically make irrational decisions. The disposition effect causes traders to hold losing positions too long while selling winners too early. Loss aversion makes the pain of a loss feel twice as intense as the pleasure of an equivalent gain, leading to panic selling during downturns. Meanwhile, herd mentality fuels bubbles, as seen in the Dot-Com Boom and the 2008 housing crisis—both driven by irrational euphoria before a catastrophic crash.

Market psychology isn’t just an abstract concept—it’s the primary force behind market cycles. Price movements are nothing more than a visual representation of collective emotion, leaving behind patterns that repeat over decades. Those who can read these psychological cycles—who recognize fear as opportunity and euphoria as danger—gain a massive edge over the herd.

To dominate the markets, you must do what the majority cannot: detach from emotion, think ahead of the masses, and act with precision when others hesitate. The real battlefield isn’t the stock exchange—it’s the human mind.

The Emotional Market Cycle: From Uncertainty to Euphoria and Back Again

Markets don’t move in straight lines; they oscillate between emotional extremes. Recognizing these cycles is the key to staying ahead.

- Uncertainty: The market is in flux. Confusion reigns. Investors hesitate, torn between conflicting signals. Volatility spikes as fear and greed wrestle for control.

- Fear: Anxiety takes hold. Sell-offs accelerate as investors rush for the exits, desperate to cut losses. The herd panics, creating deeply undervalued opportunities for those who can keep their cool.

- Excitement: The dust settles. Smart money moves in, buying assets at a discount. Prices stabilize, and a cautious optimism emerges.

- Joy: The rally gains momentum. Confidence grows. Portfolios recover, and investors start believing they made the right call.

- Euphoria: The most dangerous stage. Investors throw caution to the wind, convinced the market will only increase. Greed blinds them to risk. Bubbles form.

- The Fall: The music stops—valuations peak. Doubt creeps back in, and the cycle resets. Those who ignored the warning signs scramble to escape before the next wave of fear grips the market.

Master this cycle, and you’ll stop reacting like the masses—allowing you to buy when others are paralyzed with fear and sell when they’re drunk on euphoria.

The Fusion of Behavioral Psychology and Technical Analysis

Market psychology isn’t just theory—it’s quantifiable. The same emotional cycles that drive investors to make irrational decisions leave patterns in price action. This is where behavioral psychology meets technical analysis.

- Fear-driven sell-offs create deeply oversold conditions. Contrarian investors use this as a buy signal, exploiting emotional overreactions.

- Herd mentality fuels rallies. Momentum traders ride this wave—until sentiment turns.

- Euphoria inflates bubbles. Technical indicators like RSI and MACD flash warnings, but the masses ignore them—until it’s too late.

Example: The Dot-Com Bubble. The late 1990s saw investors piling into tech stocks, ignoring valuation metrics as greed and FOMO took over. RSI screamed overbought, yet few heeded the warning. When reality struck in 2000, fortunes were wiped out. Those who understood the psychology of bubbles saw the crash coming.

The Edge: Thinking Beyond Emotion

Successful investors don’t follow the crowd; they understand it. They recognize fear as opportunity and euphoria as danger. By blending behavioral psychology with technical analysis, they decode the market’s emotional cycles—positioning themselves ahead of the next major move.

See the market for what it is: a playground of emotions. Master that, and you master the game.

The Power of Contrarian Investing: Profiting from the Madness of Crowds

The herd mentality dominates markets. When fear grips the masses, they flee, driving prices to irrational lows. When euphoria takes hold, they chase, inflating unsustainable bubbles. But the greatest gains aren’t made by following the herd but by standing against it. Contrarian investing is the art of profiting from mass delusion.

History proves this time and time again. Warren Buffett was buying in 2008 as panic-stricken investors dumped stocks at any price. His now-famous mantra—“Be fearful when others are greedy, and greedy when others are fearful”—wasn’t just a clever soundbite but a battle-tested strategy. Those who had the nerve to buy when the market was in freefall reaped massive rewards as the market rebounded.

The same pattern played out during the Dot-Com Crash of 2000, the COVID-19 meltdown of 2020, and every major crisis before and after. The crowd reacts emotionally, but contrarians act rationally, strategically, and with conviction. This isn’t just philosophy—it’s the foundation of long-term wealth building.

Uncertainty: The Investor’s Silent Killer

Uncertainty is the Achilles’ heel of most investors. The unknown breeds fear, and fear leads to poor decisions. Studies in behavioral finance confirm that people prefer a guaranteed loss over an uncertain outcome, even if the latter offers a better chance of success. This is why so many investors sell at the bottom—they’d rather take a sure loss than endure the anxiety of uncertainty.

This effect extends far beyond the stock market. Research shows that humans handle inevitable pain better than uncertain pain. That’s why layoffs, recessions, and political instability trigger widespread anxiety—the brain fears what it cannot predict. This same fear leads investors to make irrational choices, jumping in too late and bailing out too early.

Look at 2020. As COVID-19 uncertainty gripped the world, markets collapsed. But within months, those same markets rebounded, reaching new all-time highs. Investors who let uncertainty paralyze them missed one of the greatest buying opportunities in history. Those who embraced uncertainty and acted decisively walked away with life-changing gains.

Conclusion: The Market Rewards the Bold, Not the Fearful

The market isn’t a numbers game—it’s a psychology game. Mastering emotions is the ultimate investing edge. Recognizing fear as opportunity and euphoria as danger separates the winners from the losers. The cycle is always the same: uncertainty breeds anxiety, fear creates panic, panic drives sell-offs, and sell-offs develop opportunities.

The boldest investors—those who think independently, act with conviction, and refuse to be swayed by the herd—are the ones who thrive. In markets and in life, uncertainty isn’t a threat. It’s a weapon. Learn to wield it.

Immerse in Thought-Provoking Content